It took us 4 years of making ice cider before we tried to produce a hard cider, or what people in every other country in the world just call cider. In 2007, there were very few ciders on the market, and what most people knew as cider was mass produced, very sweet and low priced, not a market we had any intention of entering. But by 2012 cider had become ‘a thing’, and people were starting to explore a broader variety of ciders, including the wonderful tannic, dry ciders being made by orchard-based cider makers like our friends at Farnum Hill Ciders (NH), Eve’s (NY) and Foggy Ridge (VA).

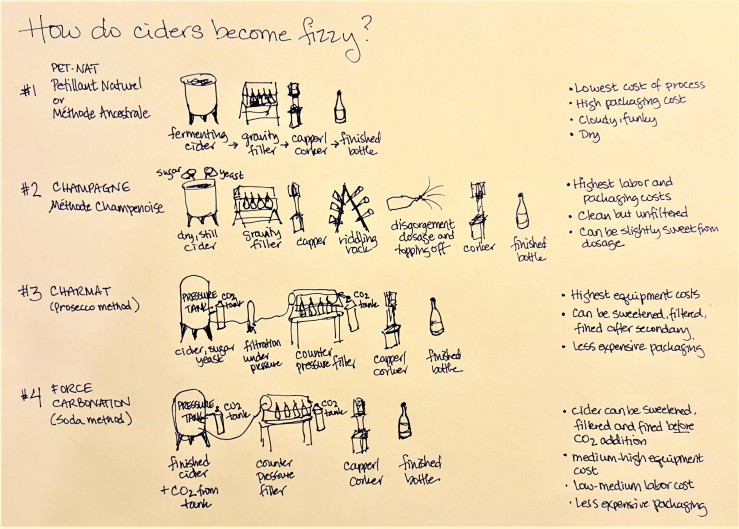

One of the most important decisions we had to make was how to produce fizz in the cider. It’s not just ‘to fizz or not to fizz’. How you produce fizz can make a big difference for other attributes of the cider, particularly cloudiness and the level of sweetness. The other big issue is how the cider gets into the bottle or can, because that has major implications for processing and equipment costs.

Left to its own devices in a vessel that allows gas to escape, fermenting apple juice, just like fermenting grape juice, will end up totally dry (all of its fruit sugars turned into alcohol), and still (all the CO2 produced by the yeast during fermentation having escaped into the atmosphere).

Here are choices one can make as a cider maker, and their implications and issues:

- Pet Nat: Finish fermentation in a heavy, pressure-rated bottle. The sealed bottle will capture natural CO2 from the fermentation process and the result will be a cloudy cider because the dead yeast (called ‘lees’) stay in the bottle. Depending on the quality and cleanliness of the process before bottling, there may be various degrees of stinkiness and/or haziness. This is referred to as Petillant Naturelle (‘Pet Nat’) or ‘Methode Ancestrale’.

- Champagne method: Take a still, dry cider base and bottle it with the addition of yeast and sugar. It will cause a new ‘secondary’ fermentation inside the bottle, which will capture the newly-formed CO2. The bottles are stored upside down so that the yeast collect in the neck. Then a process called ‘disgorgement’ is used whereby the cap is removed, the yeast residues are exploded out by the pent up pressure, the bottle is quickly topped off and corked to capture the remaning CO2. This results in a clean, naturally sparkling cider. A ‘dosage’ can be added after disgorgement while topping off to provide some sweetness.

- Charmat method: Add sugar and yeast to create a second fermentation in a pressure-rated (brite or Charmat) tank. This enables natural CO2 to be produced in the cider that can be further processed before being bottled. However, any processing – sweetening, filtration, bottling – has to be done under pressure to avoid losing the CO2.

- Force-Carbonation: Dissolve pressurized CO2 gas from a cylinder into a finished still cider in a pressure tank using a relatively inexpensive piece of equipment called a carbonation stone.

For any method that doesn’t capture natural CO2 in a bottle, you can’t get the cider into a bottle or can without some kind of counter-pressure filler, otherwise the gas will escape in the bottling process. That means the least capital intensive approaches are the Pet Nat and Champagne methods, however the disgorging process for the champagne method is extremely labor intensive. On the other hand the variability and funkiness of Pet Nats can be challenging for trade and consumers.

At some point, most small producers end up purchasing a brite tank and a counter-pressure filler, which allow for the production of clean, carbonated ciders with less labor cost. That’s an investment of somewhere between $20K – $30K. Note we are still talking just semi-automation. This equipment still requires people to put each bottle one at a time on the filler, to be handed-off to another person putting on the closure, and someone else putting on the label. Automatic bottling lines begin at $100K and go up. We once priced the smallest automated champagne ‘disgorging’ system at $250K. You can rent a system by hiring a mobile bottling or canning line. The minimum size batch for a mobile-canning line to process is 2,300 gallons, which means you have to have a brite tank(s) that can hold that volume under pressure to connect to the canning line.

There are two other factors in costing these options – sweetness and taxation. Those are post-worthy topics in themselves and I’ll get there. In the meantime, next time you are shopping for ciders, try to find an example of each of these four types and see what you think the differences are in taste and cost.

What choice did we make? None of the above at the beginning. We started a fermentation of Kingston Black using champagne yeast, and then added into it, bit by bit, an equal amount of already finished still dry cider from the prior year’s heirloom blend apple varieties that had been aged for eight months. Then we bottled the combined cider near the end of its active fermentation to capture naturally produced CO2. The result is…a Pet Nat that we then disgorged by hand to remove the lees?…or a champagne method with a secondary fermentation done with new juice, not sugar?…or is it just something new, ‘Methode Leger’? Whatever it is, it certainly isn’t cheap.